You would probably have used the CPF Education Scheme to fund for your tertiary education in NUS, NTU or SMU. In fact, from personal experience of a local grad, people will want to exploit this scheme as an alternative to “withdraw” funds from their CPF! This comes forth from the perspective that the CPF funds indirectly belongs to you.

Today, besides the usual stuffs that you already knew, we are going to tell you what you did not know about the CPF Education Scheme.

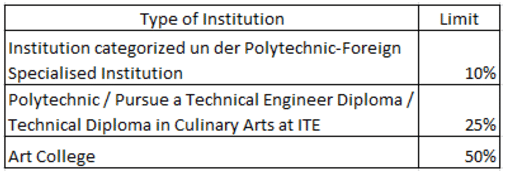

A short introduction: The CPF Education Scheme is an education loan scheme administered by the CPF where you can utilise your parents’, relatives’, siblings’ or your own CPF’s Ordinary Account (OA) to fund your education. However, there is a cap when utilising your relatives’ CPF for the Education Scheme, as summarised succinctly below.

The interest rate is pegged to the CPF OA’s interest rate and calculated on a monthly basis.

Now here are the things that I bet you did not know:

- Interest starts accruing the moment the funds are withdrawn from the CPF OA up till when the amount is fully paid. This is a stark contrast from the private education loans administered by local institutions, where generally, interest will only start accruing upon graduation. This is, however, subject to the approval of the school and there are usually guidelines to comply to.

This means that it is generally more cost effective to subscribe to school-administered education loans compared to CPF Education Loan due to the lower interest bearing period, considering that the interest rates are the same. - I have heard of people being excited that they managed to defer payment for the “loan” in the CPF Education Scheme. They seemed to feel that they have managed to exploit a loophole in the system. There’s a myth debunked. Interest will still accrue during the deferment period. In addition, your monthly repayment will likely increase. The period of deferment is accounted for in the maximum repayment period and this means that to repay a larger amount in a shorter period of time, you need to start paying more every month! Not a very fantastic “loophole”…?

- Not many people knew about this but you can actually waive the repayment of the CPF Education Loan. Yes, you read that right. You can waive the repayment. Nonetheless, this is subjected to conditions.

- If your parent is aged 55 and above

- If your parent has met the Full or Basic Retirement Sum with sufficient property pledge in the Retirement Account

- Your parent can actually apply to CPF to waive the repayment. However, one disadvantage of this is that this is considered a withdrawal from CPF at age 55 and the total amount waived includes the interest accrued and the principal. This means that if FRS or BRS is not met, it is highly likely that the $5,000 withdrawal limit at age 55 will be fully utilised for the loan amount and your parent cannot withdraw any cash from his CPF.

Also do you know CPF Education Scheme was championed by Dr Tan Cheng Bock.

Please share our post if you think this article is relevant.

Read also: Is the New CPF LIFE Escalating Plan a good deal?