Set to launch in the beginning of 2018, the new CPF LIFE Escalating plan is another retirement payout option for retirees to choose from beside the currently existing plan – the Basic Plan and the Standard Plan.

The new plan includes 2 features:

- You start with a lower monthly CPF LIFE payout (20% lower than the standard plan).

- Your CPF LIFE payout increases by 2% every year

Who will Benefit from this?

- Those who are likely to live a very long life. Telltale sign: you have a family history of having relatives with really long lives, like 90+ years old.

- Women. Because women tend to live a longer than men, it makes economic sense for them to be in a plan that will see payouts increasing year over year.

What are some Drawbacks?

- Although the money is increasing every year, inflation is also increasing every year, possibly at a rate higher than 2%. I would assume a long-term inflation rate of 3% because that is also the rate CPF uses – the Full Retirement Sum will increase by 3% for each year from now till 2020. The increase is to adjust the amount for inflation. Your money is losing to inflation, but at a slower rate than if it was not increasing by 2% every year.

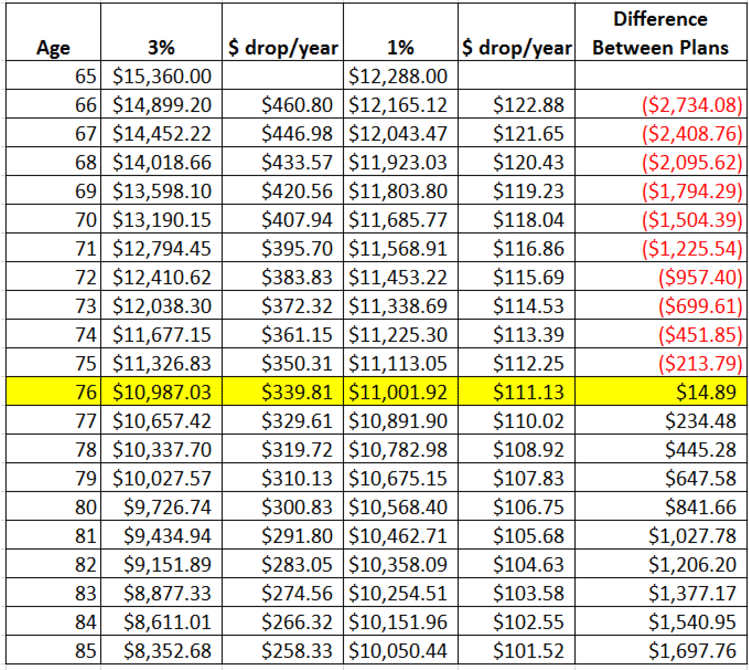

We did some calculations on our own. Turns out that after 11 years, the Escalating Plan will be worth more than the Standard Plan in current dollars.

Complex mathematics simplified: your money is worth less as time goes by (aka inflation), using 2017 dollars as a baseline, we are calculating how much each dollar you get in the subsequent years are worth in 2017 dollars. $1 of today is worth more than $1 of next year.

Read also:CPF Lease Buyback Scheme

Meaning, at age 80, the $15,360 you receive from CPF is worth in the year 2017 $9,726

Assumptions in the model:

a) You have the Full Retirement Sum in your Retirement Account

- b) Long-term inflation rate of 3%

- c) Annual figures are used ($1,280 monthly payout x 12 months)

- d) Standard Plan inflation rate is 3%, Escalating Plan net inflation rate is 1% (3%-2%)

- e) Escalating Plan starts with a payout 20% less than the Standard Plan

As noted by the yellow row, by the time you reach 76 years old, the Escalating Plan pays out more than the Standard Plan. This means while you get more payout from the Standard Plan at first, after 11 years, the Escalating Plan pays out more in monthly payouts than the Standard Plan in current dollars.

- If you are thinking of choosing the Standard Plan, then personally set aside 20% of it to invest and earn a higher return than the 2%, it is not that easy. In order to earn 3% just to match up with inflation, your 20% pool of money you set aside have to earn 15%.

Eg; my monthly payout is $1,000. I set aside $200 to invest.

Because of 3% inflation, my money will be worth $970 the next year.

In order to make it worth $1,000, my $200 have to earn me $30 in 1 year.

$30/$200 = 15%

The long-term stock market return is about 9%+, you probably do not want to take on too much risk when you are old just to get that 15%.

Also read: CPF Housing Grant for Resale HDB to be increase for First Time Buyer

Conclusion:

Everyone has different needs and different lifestyle requirement. Some might wish to receive higher payouts at the beginning, others might wish to receive higher payouts towards the end of their retirement, while there are also those who would like to leave more money behind for their dependents.

Whatever requirements you have, always pick one that is the most practical to your needs and never risk jeopardising your retirement!