In examining the DBS Woman’s World Card, we uncover a credit facility tailored to maximise the potential of every dollar spent, especially for those who frequently engage in online transactions. Renowned for its impressive rewards program, the card is designed not only for women as the name suggests, but is available for application by men as well. Offering a raft of benefits, such as an attractive air mile conversion rate and a rich online spend rewards system, the card positions itself as a frontrunner in the competitive world of credit card rewards.

Understanding the financial tools we utilize is crucial to making informed decisions, and thus, a close look at the DBS Woman’s World Card illuminates its strategic value in the personal finance arsenal. As we traverse through the card’s features and offerings, it becomes evident that one may leverage this card to accrue substantial rewards without compromising on security or incurring excessive fees. The eligibility criteria and application process are streamlined, ensuring accessibility to a wide base of users.

Key Takeaways

- The DBS Woman’s World Card is a versatile rewards card with a high earn rate for online spending.

- Application is straightforward, with clear eligibility requirements fostering inclusivity.

- It provides strong security measures, maintaining user confidence against fraud.

Here are some of our top picks on:

- Review: DBS Altitude Card Singapore

- Review: HSBC TravelOne Card Singapore

- Review: OCBC Titanium Rewards Card Singapore

Overview of DBS Woman’s World Card

The DBS Woman’s World Card is marketed as a gender-neutral credit card despite its name, and we recognize it as a valuable asset for any cardholder looking for rewards on their spending. With this card, we can earn a substantial amount of reward points, particularly from online purchases.

Card Features:

- Annual Fee: Waived for the first year

- Income Requirement: High, at S$80,000 per annum

- Rewards: 4 miles per dollar (mpd) for the first S$2,000 in online spend per month

Let us examine the rewards structure more closely. For the first S$2,000 of online expenditure each month, the card offers an impressive 4 mpd. Beyond this cap, other purchases earn rewards at a different rate.

Eligibility:

| Criterion | Requirement |

|---|---|

| Age | 21 years and above |

| Income | Minimum of S$80,000 p.a. |

We must note that this card is accessible to both men and women, despite any implications the name may have. The DBS Woman’s World Card presents itself as a competitive option for anyone aiming to maximize their rewards, especially through online shopping. Understanding the card’s benefits and requirements helps us make an informed decision on whether it aligns with our spending habits and financial goals.

Card Eligibility and Application Process

In this section, we provide clear guidance on how interested individuals can apply for the DBS Woman’s World Card. We cover the specific requirements applicants need to meet, the steps they should follow to apply, and the documents that are necessary to complete the application process.

Eligibility Criteria

- Age: Applicants must be at least 21 years old.

- Income: The minimum annual income requirement for Singaporeans and Permanent Residents is S$30,000. For foreigners, the minimum income requirement is higher, typically S$45,000.

- Credit History: A good credit score is essential for approval, as it indicates to the bank that the applicant is a responsible borrower.

Application Procedure

- Visit Official Site: Begin by visiting DBS Bank’s official website to access the online application form for the DBS Woman’s World Card.

- Fill Application Form: Complete the application form with accurate personal, employment, and financial information.

- Submit Application: After reviewing the information, submit the application online for processing.

Required Documents

For Salaried Employees:

- Latest 12 months’ CPF Contribution History Statement, or

- Latest Income Tax Notice of Assessment and latest computerized payslip.

For Self-Employed / Commission-based Employees:

- Latest 2 years’ Income Tax Notice of Assessments.

For Foreigners:

- Passport copy,

- Employment Pass (with at least 6 months’ validity), and

- Latest Income Tax Notice of Assessment or latest computerized payslip.

Rewards and Benefits

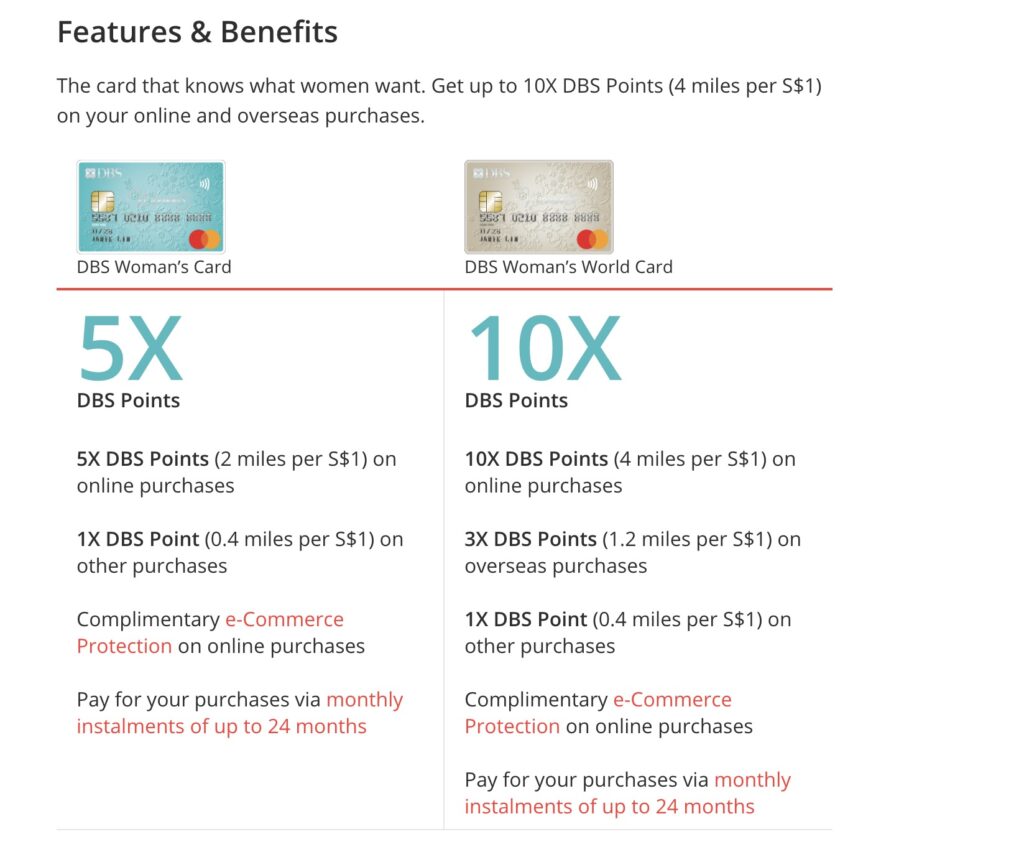

We find that the DBS Woman’s World Card in Singapore offers a competitive range of rewards and benefits that cater to both travel enthusiasts and those who enjoy lifestyle perks. Here, we break down the miles accrual rates, the bonus points system, and the lifestyle benefits associated with the card.

Miles Accrual Rates

The DBS Woman’s World Card allows us to accrue airline miles at different rates depending on the spending category:

- Local Spend: For every S$5 spent in Singapore Dollars, we earn 1 DBS Point, which is the equivalent to 0.4 miles per dollar (mpd).

- Foreign Currency Spend (FCY): For every S$5 spent in foreign currency, we earn 3 DBS Points. Considering 1 DBS Point is equal to 2 miles, this is an effective rate of 1.2 mpd. However, there is a 3.25% FCY transaction fee to consider.

Bonus Points System

The DBS Woman’s World Card features a bonus points system that heavily favours online spending:

- Online Spend: We can earn 10 DBS Points for every S$5 spent online, which translates into a rate of 4 miles per dollar (mpd), subject to a cap on the bonus points we can earn each month.

Lifestyle Benefits

In addition to the points and miles we can accumulate, this card also comes with lifestyle benefits which include:

- Annual Fee Waiver: The card typically offers a waiver of the annual fee for the first year.

- Exclusive Deals: Cardmembers have access to various promotions, such as Agoda staycation deals and other periodic offers.

- Redemption Options: The points we collect are versatile and can be redeemed for air miles, products such as AirPods through the DBS Rewards Apple Store, or even cashback.

Understanding the Fees

When considering the DBS Woman’s World Card, we need to examine the various fees associated with it, which include annual fees, applicable interest rates for balances carried over, and charges on foreign transactions.

Annual Fees

- Principal Card: The annual fee for the primary card is S$192.60, which is waived for the first year.

- Supplementary Card: For each supplementary card, the annual charge is S$96.30.

Interest Rates

The annual interest rate for the DBS Woman’s World Card is pegged at 26.80%, which applies to the outstanding balance if full payment is not made by the due date.

Foreign Transaction Fees

For transactions made in foreign currencies (FCY), card members are charged a foreign transaction fee of 3.25%. This fee is added on top of the converted amount in Singapore Dollars.

Card Usage Guide

In this section, we’ll guide you through maximizing the benefits of the DBS Woman’s World Card, focusing on online transactions, overseas spending, and merchant partnerships.

Online Transactions

When using the DBS Woman’s World Card for online purchases, cardholders are rewarded handsomely. For every S$5 spent online, you earn 10 DBS Points, which equates to 4 miles for every S$1 spent online, up to the first S$2,000 each month. It’s important to note that subsequent online expenditures beyond this cap will accrue points at the standard rate.

- Maximize Online Rewards: Aim to use the card for all online transactions up to S$2,000 monthly to reap the maximum number of DBS Points.

Overseas Spending

For expenses incurred overseas, the DBS Woman’s World Card also offers an elevated earning rate. You will accumulate 3 DBS Points for every S$5 of foreign currency (FCY) spent, translating to 1.2 miles per S$1. Be mindful that a foreign currency transaction fee of 3.25% applies, which should be factored into the cost-benefit analysis of using the card abroad.

- Optimizing Overseas Expenditure:

- Use for all FCY transactions to earn triple the points.

- Be aware of S$2,000 cap for higher rewards and transaction fees.

Merchant Partnerships

The DBS Woman’s World Card offers additional perks through partnerships with a variety of merchants. These partnerships often entail special promotions, discounts, or enhanced rewards when using the card at participating outlets. Keep an eye on updated lists of merchant ties to ensure you don’t miss out on offers.

- Leveraging Partnerships:

- Regularly check for updated promotions.

- Plan purchases around partner offers to maximize benefits.

Comparison with Other Credit Cards

When we assess the DBS Woman’s World Card, it’s crucial to evaluate its features against other credit cards in the market to understand its positioning.

The DBS Woman’s World Card offers a high earn rate for online purchases which stands at 4 miles per dollar, capped at S$2,000 spend per month. This is a competitive rate among cards focusing on online shopping rewards.

In contrast, other credit cards like the Citi Rewards Card also provide 4 miles per dollar on online spend but have a lower monthly cap of S$1,000. The UOB Preferred Platinum Visa Card, meanwhile, offers 4 miles per dollar on online and contactless spend but has an even lower cap of S$480 per month.

Here’s a brief comparison:

| Credit Card | Earn Rate (Online Purchases) | Monthly Cap for Max Earn Rate |

|---|---|---|

| DBS Woman’s World Card | 4 miles/dollar | S$2,000 |

| Citi Rewards Card | 4 miles/dollar | S$1,000 |

| UOB Preferred Platinum Visa Card | 4 miles/dollar | S$480 |

The annual fees also differentiate the cards. Our DBS Woman’s World Card comes with an annual fee of S$192.60 which is waivable with a specified annual spend, akin to the Citi Rewards Card but higher than the UOB Preferred Platinum Visa Card.

Our reward points do not expire, a competitive advantage as some other cards require points redemption within a specific period.

In terms of extra perks, while we offer rewards like lifestyle and wellness benefits which are tailored particularly to women, other cards may offer broader but less targeted perks. This distinct positioning can make the DBS Woman’s World Card particularly appealing to specific user segments.

Customer Experiences

When assessing the DBS Woman’s World Card, we’ve gathered insights from numerous customers to paint a realistic picture of their experiences. Here, we summarize these accounts using direct formatting to clarify the key takeaways.

Usage Flexibility:

- Many customers appreciate the card’s gender-neutral benefits despite its name.

- Cardholders frequently mention the convenience of accruing up to 96,000 miles per year with a S$2,000 monthly cap on online spending.

Rewards Satisfaction:

- Users often express satisfaction with the 10X Points program for online purchases.

- Some customers highlight the added value they find in a variety of redemption options, from air miles to tech gadgets.

Sign-Up Perks:

- The lack of an annual fee in the first year is commonly cited as a positive initial draw.

Table 1: Customer Feedback Summary

| Category | Positive Feedback | Negative Feedback |

|---|---|---|

| Online Spending Rewards | High mile-earning potential | Monthly cap on earnings |

| Redemption Flexibility | Diverse options, including miles and tech | Limited to certain categories |

| Initial Perks | No annual fee in the first year | Annual fee post-first year |

We dispense with overstatements and stick to facts; our research has shown the DBS Woman’s World Card to be a well-regarded choice among a broad customer base, with special accolades for its rewards program and the initial offerings to new cardholders.

Security Features

We understand the importance of security for our cardholders. The DBS Woman’s World Card incorporates robust measures designed to protect against fraud and provide efficient card replacement services.

Fraud Protection

Our DBS Woman’s World Card offers a comprehensive fraud protection system designed to shield cardholders from unauthorized transactions. In the event of suspicious activity, our monitoring system will:

- Alert: Notify us and the cardholder immediately via SMS or email.

- Block: Temporarily disable the card to prevent further potential unauthorized transactions.

We actively work to detect and respond to fraud swiftly, ensuring our cardholders’ finances are secure.

Card Replacement Services

In case of loss or theft, our card replacement services are swift and efficient, minimizing inconvenience. When our cardholders report a lost or stolen card, we immediately take the following steps:

- Deactivate: The compromised card is deactivated to prevent fraudulent use.

- Issue: A new card is issued and sent out with expedited shipping options, subject to availability.

We aim for a quick turnaround to ensure our cardholders have uninterrupted access to their account.