eToro is a reputable multi-asset brokerage firm and a social trading broker headquartered in Israel. Since its inception in 2007, the FCA-regulated platform has grown exponentially and now serves international markets such as Australia and the United Kingdom.

eToro is a legitimate entity as it is monitored by a renowned regulator. Its operation is characterized by CFDs, which are multifaceted instruments that involve leverage. As such, they sport a higher risk.

When it comes to CFDs, keep in mind there are risks and you should only invest what you are willing to lose. In fact, the leverage associated with CFDs is the reason 60% of retail traders don’t make a killing in trading. Experts advise that you should use little leverage when trading with CFDs.

That being said, let us expound more about eToro, and determine if it is worth your money:

What is eToro?

eToro lets you purchase, sell and trade financial instruments. As mentioned earlier, the company was established in 2017 and has its headquarters in Cyprus. While it started as a CFDs-centric entity, it has since then ventured into other areas on the online brokerage field.

Today, eToro allows traders to own the assets they invest in, including cryptocurrencies, and the conventional stock market equities, as well as stock market indices, forex, and ETFs commodities for CFD offering.

Among the notable benefits of using a trading platform such as eToro is that it is also friendly to beginner traders. So, regardless of your experience and skills, trading assets through the eToro platform is as easy as it gets. What’s more- and most notably, eToro was among the first platforms to introduce the social trading concept.

This feature lets users share and converse about portfolio stratagems through the Copy Trading feature. Additionally, amateur investors can ape the trades of other traders like for like. It is this, among many other incredible features that make eToro a reliable platform online stock brokers, catering to both beginner and experienced traders.

What about regulatory status?

Three primary financial organizations back the eToro platform- the Exchange Commission and Cyprus Securities in its home jurisdiction, as well as the Australian Securities and Investments Commission (ASIC) and Financial Conduct Authority (UK).

Lastly, we should mention- in line with eToro’s target audience of beginner investors, the platform supports a range of payment methods. This includes bank account transfers, credit & debit cards, as well as e-wallets like Skrill and PayPal.

Now that you have a rough idea of the platform, stick around as we expound more including the types of financial instruments to consider while using the platform.

Trust

Once again, eToro is a reliable platform with backings from the European Securities and Market Authority (ESMA) and the Cyprus Securities & Exchange Commission. However, some traders are concerned about the Cyprus domicile, especially given the country’s 2012 financial crisis.

If it will make you feel safer- the platform is licensed and monitored by the Financial Conduct Authority (FCA) from the UK, which demands an in-depth risk disclosure. As such, the broker has the right to hold client money in banks out of the European market, fostering risk if a bank default. However, they provide UK and EU broker default protection up to 50000 pounds or 20000 euros.

There is no stop-loss protection or any form of protection by private insurance providers. Furthermore, the order entry interface is inadequate and doesn’t include management features apart from trailing stops and stops.

Cryptocurrency stop losses cannot be less than 25% of exposure. This, in turn, increase investor risks and limits customization. According to ESMA 2018 negative balance protection rule, investors cannot lose over 100% of their account value.

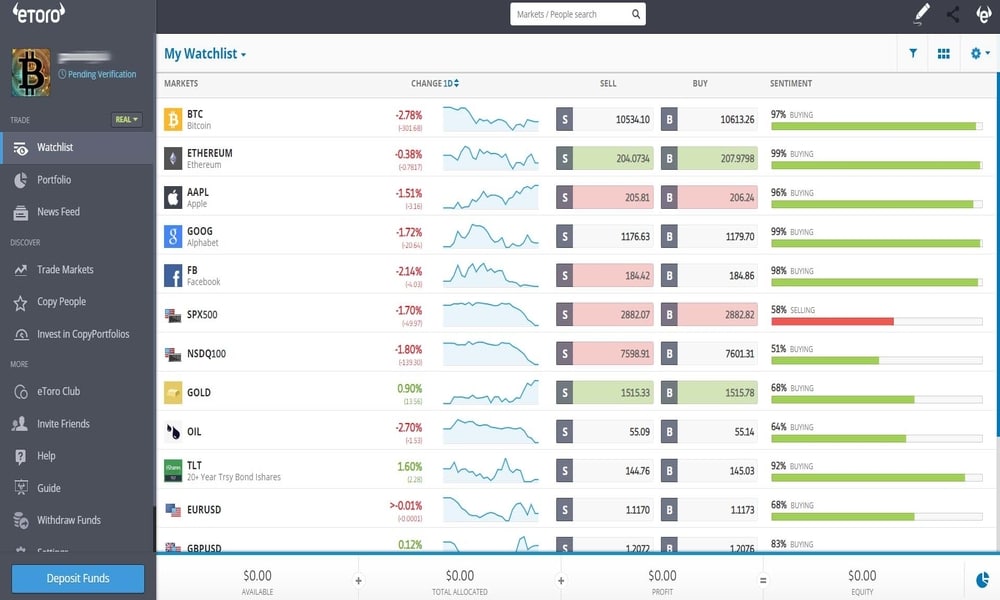

Desktop Experience

As aforementioned, eToro is a web-based social trading podium, machined for ease of use over complexity. The simplicity- will make both novice and proficient fall in love with the platform.

Note, however…

eToro lacks a standalone version.

While charting does not include backtest functionality, it is full-featured with plenty of drawing tools and indicators. It also has performance data from CopyPortfolios and CopyTraders.

We also have an issue with the News link- it does not offer much other than opening into a social forum where users posts. Meanwhile, you can personalize the watch lists and save. The platform doesn’t have MetaTrader and the order entry doesn’t feature risk management capacity.

The watch list entries display trader buying and selling metrics in real-time, which enables fast sentiment analysis. In 2017, CopyTrader and CopyPortfolios joined efforts to help in mirroring positioning in real-time.

Mobile Experience

eToro mobile platform is compatible with Android and iOS devices. The software is mobile-friendly, allowing easy navigation between platforms with easy to access features. However, there is limited customization and fewer charting features.

Their indicator menu features five types and the order entry system is the same as the desktop version. The platform allows you to set personalized price notifications while also getting push notifications regarding account issues and market events.

Research Tools and Insight

There is only one thing we could say about research on eToro- Bare-boned! Plus, it is scanty and can only be accessed via a blog that has many untimed basic contents. The mobile version has a research button, which when pressed, shoots out a message that shows that analyst research is available in funded accounts only.

It seems like most of the blogs are geared toward cryptocurrencies and less on market analysis or forex. A few more articles cover technical analysis or instrument-centric fundamental analysis.

Education

Strangely, they have placed a Trading Academy in the foot of the interface and not at the top menu. Also, at the bottom, there is a Live Webinar link that leads to a page with neither archives nor programs.

Meanwhile, the education portal has only 11 elementary programs, available in PowerPoint-like manner. There is also a course, “Advanced Technical Analysis”, available for users. There is no educational content on the platform other than instrument and platform descriptions in the help databases and FAQ. Moreover, eToro has a YouTube video library, with a tutorial segment that offers “how-to” lessons.

Security features

The platform features standard SSL encryption and mobile-based two-step authentication. A long documentation on execution and conflict of interests is also available. However, the broker plays the role of counterparty and market maker in the trades. Fee disclosures are straightforward, although extensive. There is also a marketing brief that states client money is held only at tire-one institutions.

Special Features

eToro’s main focus includes in-platform social sentiment data, social & copy trading, and also the automated client. Moreover, they offer negative balance protection to users as a free incentive since it is not a requirement under ESMA rules.

The fact that the platform does not have a volume discount program makes it costly, although the entity has the eToro Club program that offers additional services based on the size of the account, as well as discounts.

We still feel there are a couple of aspects that eToro could work on. They should consider order guaranteed stop-loss protection and order management because this will help to reduce the risk of massive losses, especially when it comes to cryptocurrency coverage that features little to none stop-loss functionality.

A VPS hosting or an API interface could help address these mishaps, but sadly, none of these options exist. This makes eToro ideal for investors who are looking to take advantage of the mechanisms that are used by veteran traders, as in the CopyTrader portfolio or proprietary algorithms.

On 7th March 2019, eToro released its blockchain wallet for iOS and Android platforms- it is now available in more than 30 states. There are about 15 cryptocurrency types to be used in the US and 16 more in other nations. Among the popular cryptocurrencies include Stellar Lumens (XLM) and Bitcoin (BTC).

Their new feature has expanded its reach in the United States. Keep in mind however, US traders only have access to cryptocurrencies and those from other countries can consider either stocks, CFDs, forex, or cryptocurrencies.

Investment Products

The investment product catalog is quite limited with around 19 index/commodity CFDs and 47 currency pairs. The platform also offers more than 1500 shares and 77 cryptocurrency CFDs.

Investors can trade on the short or long side. However, it would be best if you go through the fine print since every venue and order type attracts varying weekend and overnight holding costs.

What is interesting about this platform though is that its algorithms can penetrate markets that are not readily available on CFDs. While you are allowed to manage an aggressive program to discourage conflicts of interest, they only play the role of the counterparty, allowing for bid and ask values that are not in light with consolidated market feeds.

Commissions and Fees

Index spreads, commodities, and minimum forex are too high. For instance, EUR/USD stands at 3.0 pips while the S&P 500 stands at 75 pips. Furthermore, spreads are likely to widen considerably because the market is highly volatile and fluctuates frequently.

On the other hand, weekend and overnight holding costs are above the market cap and can significantly compromise profitability. eToro offers a reasonable spread per side for shares and recently launched commission-free stock trading. However, weekday stands at 23 cents/$1000 upon long exposure. While there is no overnight cost on non-leverage long exposure but the cost will triple over the weekend.

What about the broker fee?

The broker deducts $25. Keep in mind there may be extra fees including credit or bank charges for withdrawals, plus there are no withdrawals of less than $50. The platform has a dedicated page that displays all the withdrawals and additional fees applied.

A fee of $10 is charged for accounts that have been inactive for at least 12 months, and as we mentioned before, there is an eToro Club program that provides additional services and discounts, based on account size.

Customer Support

eToro offers 24/5 customer support but the contact page does not have contact numbers except for the Australian section. Clicking “Help Center” from the bottom of the Homepage takes you to an FAQ and trending articles.

The phone number link on the page takes you back to the contact page, which could be a bit frustrating, especially for new customers. Current customers have access to live online chat. The customer service link will take you back to the database and ticket menus. However, the company has active social media channels, which are mainly used for marketing and analysis entries.

Advantages of Using eToro

- Nice mobile experience.

- It is a social trading platform.

- A lot of options for cryptocurrencies.

- Trade copying is integrated.

Disadvantages of Using eToro

- High fees

- Withdrawals work for a few cryptos.

- US traders can only use crypto trading.

- Poor customer support

How to Open An eToro Account?

To open an eToro account, you need to deposit a minimum of $50 for the Australia and United States investors and $200 for investors in other nations. The maximum deposit amount per day is 10,000 per day.

Demo Account

The demo account provides unlimited access to traders with $100,000 for practicing. Thus, you can learn a lot before you decide to invest real money into the business.

Wrapping things up…

eToro, as we have seen involves social trading and operates and apes much of its features from Robinhood. While the latter offers services millennial traders trading at an affordable low-cost mechanism, eToro is designed to be accessed via copy-trading.

This strategy has worked well for eToro, especially for the perfect passive individuals who want to play a part in share trading ideas and sign up on eToro despite its exaggerated high charges or lack of other crucial services like customer support.

The platform is also a commendable service for proficient, successful retail investors who would like to share their ideas instead of rewards. While the platform has a user-friendly interface, it is not recommended for beginner traders who would like to know more about trading, be more active, or want access to active customer support.