As enthusiasts in the realm of personal finance and card benefits, we’re examining the DBS Vantage Card, a notable addition to Singapore’s credit card market. This mid-tier luxury card is aimed at a discerning clientele, catering to individuals who seek elevated travel experiences and dining pleasures. A key aspect that distinguishes the DBS Vantage Card is its high earn rate for both local and overseas expenses, allowing cardholders to accumulate rewards at an accelerated pace.

Tapping into the segment that requires cardholders to have a notable annual income, the DBS Vantage Card lures customers with a suite of perks that includes but is not limited to, Accor Plus Explorer membership and a number of lounge visits, positioning itself as a strong contender in the travel credit card space. However, the card doesn’t just confine itself to travel perks; it extends its rewards to include dining privileges and various spending categories, making it a versatile option for those who seek rewards beyond the airport lounge.

Key Takeaways

- The DBS Vantage Card offers notable travel and dining benefits for high income individuals.

- It features high reward earn rates for both local and overseas spending.

- Versatility extends through multiple spending categories, enhancing its appeal.

Here are some of our top picks on:

- Review: DBS Altitude Card Singapore

- Review: UOB Visa Signature Card Singapore

- Review: HSBC Revolution Card Singapore

Card Overview

In this section, we provide a focused look at the DBS Vantage Card’s fundamental costs and its distinctive design and materials.

Annual Fees and Charges

The DBS Vantage Card charges an annual fee which reflects its positioning in the premium credit card market. Terms and conditions apply, and fees may be subject to waivers under promotional offers or meeting specific spend criteria.

- Annual Fee: Subject to the current pricing policy.

- Late Payment Charges: A charge applies if the minimum payment is not met by the due date.

- Interest Rate: A competitive rate is applicable for outstanding balances.

Cardholders should review the full fee schedule for additional costs such as cash advance fees and foreign transaction charges.

Card Design and Materials

The DBS Vantage Card distinguishes itself with a high-quality metal finish, catering to the aesthetic preferences of the mass affluent segment.

- Material: Premium metal

- Design: Sleek and modern aesthetic

Possessing a metal card such as the DBS Vantage offers a tactile and visual symbol of the card’s exclusive status within the credit card offerings.

Rewards and Benefits

The DBS Vantage Card offers an attractive suite of rewards and benefits tailored to frequent travelers and high spenders. Key components of these rewards include a competitive earning rate, flexible redemption options, and a host of exclusive privileges that enhance the cardholder’s lifestyle.

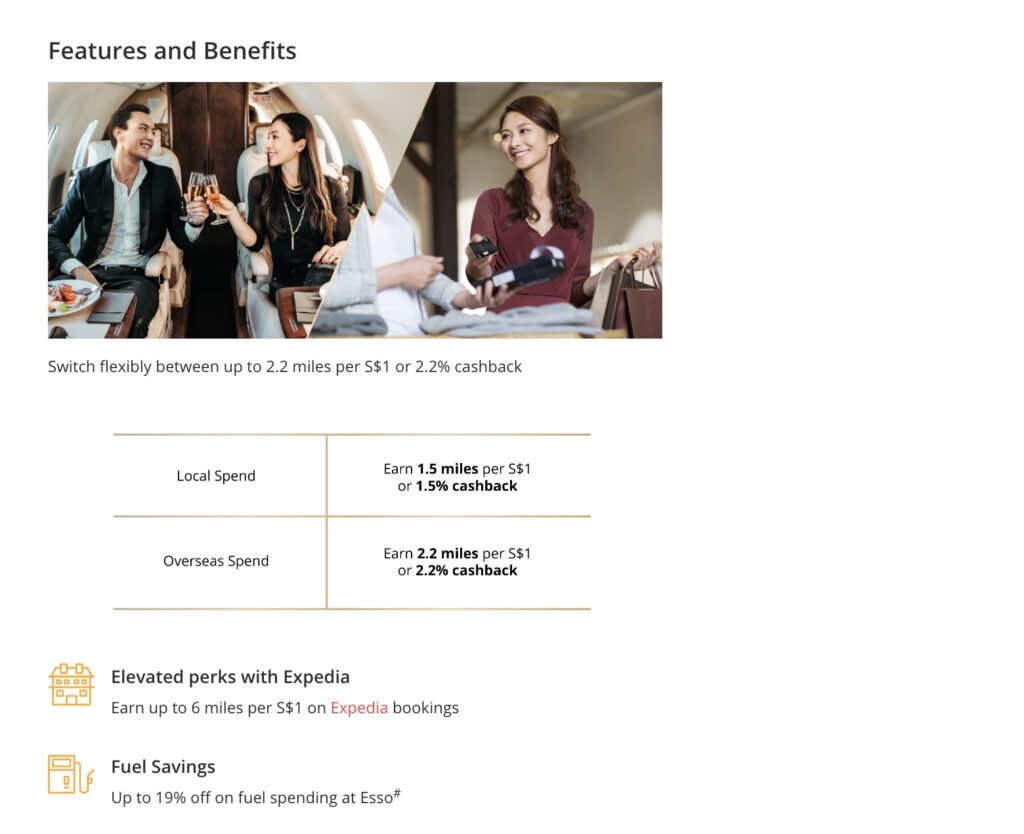

Earning Rate

- Local Spend: Earn up to 2.2 miles for every S$1 spent.

- Overseas Spend: Transactions made abroad fetch an even higher rate, with cardholders accruing 2.2 miles per S$1 spent.

Redemption Options

We can redeem the miles we accumulate in several ways:

- Flight Bookings: Miles can be directly applied to book flights on various airlines.

- Hotel Stays: They can also be used to secure hotel stays, offering a way to reduce travel expenses.

- Conversion: Miles can be converted into vouchers or used for other redemption offers that DBS may provide periodically.

Exclusive Privileges

The exclusive privileges we enjoy with the DBS Vantage Card are multifaceted, designed to cater to diverse needs:

- Dining Benefits: Access to dining offers at select restaurants.

- Travel Perks: Complimentary travel insurance and access to VIP lounges at airports.

- Yearly Bonus: Upon renewing the card and paying the annual fee, we receive 12,500 DBS Points, equivalent to 25,000 miles.

Eligibility and Application

Before applying for the DBS Vantage Card, it’s important to understand the specific eligibility criteria, what documents you’ll need, and the steps in the application process. Let’s break down each part to ensure a smooth experience.

Qualification Criteria

To be eligible for the DBS Vantage Card, applicants must be:

- Aged 21 years or above.

- Earning a minimum annual income of S$120,000. This applies to Singaporeans, Permanent Residents (PR), and foreigners with a valid Singapore Employment Pass.

Required Documents

Our application will necessitate the following documents:

- For Singaporeans and PRs: NRIC or Passport.

- For Foreigners: Passport and Employment Pass.

- Proof of Income: Recent payslips, bank statements, or tax assessments.

Application Process

Applying for the DBS Vantage Card involves:

- Completing an online application form on the DBS website.

- Submitting the necessary documents, typically as digital uploads.

- Awaiting approval, which can take anywhere from 3 to 10 business days once all requisite documents are received and verified.

Spending Categories

In our review of the DBS Vantage Card, we find that it offers distinct benefits across different spending categories, rewarding users for both local and overseas expenditures.

Local Expenditure

For every S$5 spent in Singapore Dollars, cardholders earn 3.75 DBS Points. Since 1 DBS Point equates to 2 miles, this results in an effective rate of 1.5 miles per dollar (mpd) for local spending. It’s noteworthy that this earn rate applies without the need for reaching a minimum spend, and there are no caps on the miles to be earned.

Overseas Spending

When using the card for foreign currency transactions, for every S$5 spent, the earn rate increases to 5.5 DBS Points. Translated into miles, this comes to 2.2 mpd. The lack of a minimum spend requirement and the uncapped miles earning potential make it particularly appealing for those who spend frequently in foreign currencies.

Additional Features

In providing insights into the DBS Vantage Card, we consider the additional functionalities that enhance the user experience, particularly the Mobile Payment Compatibility and Travel Insurance provisions.

Mobile Payment Compatibility

The DBS Vantage Card is designed with modern consumers in mind, leveraging the convenience of mobile payment platforms. We ensure that cardholders can integrate their card with major mobile wallets, including Apple Pay, Google Pay, and Samsung Pay. This compatibility allows for seamless transactions and a secure checkout process across a variety of vendors and locations.

Travel Insurance

We recognize the importance of travel insurance for cardholders who frequently journey abroad. The DBS Vantage Card provides a comprehensive travel insurance policy that covers various unforeseen events. The policy includes coverage for travel accidents, medical emergencies abroad, and flight delays, ensuring cardholders have peace of mind during their travels.

Details of the insurance coverage can typically be found in the cardmember agreement or by contacting DBS customer service for the most up-to-date information.

Customer Service

In our exploration of the DBS Vantage Card, we’ve discerned that customer service quality is crucial for cardholders experiencing issues or needing guidance.

Support Channels

We’ve identified that DBS offers several support channels for Vantage Card customers to address their inquiries and issues. You can contact customer service through:

- Phone: Dedicated hotline for immediate assistance.

- Email: For less urgent concerns that require detailed explanations.

- Live Chat: Accessible via the DBS website for quick questions.

- Branch Visit: In-person support for complex issues or direct interactions.

Response Time

Our findings suggest that response times can vary depending on the selected support channel:

- Phone Support: Generally rapid with calls typically answered within a few minutes.

- Email: Responses can take up to 48 hours, but complex queries may require additional time.

- Live Chat: Often immediate, with minimal waiting time.

- Branch Visit: Wait times can depend on branch location and hours, but service is usually prompt once a customer service representative is available.

Pros and Cons

We consider various factors to determine the advantages and disadvantages of the DBS Vantage Card. Our analysis provides insights into the potential benefits and drawbacks for cardholders.

Advantages

- Miles Earning Capability: The DBS Vantage Card offers a competitive miles earn rate. For local spend, cardholders earn 1.5 miles per S$1 and a higher earn rate of 2.2 miles for overseas spend, making this an attractive option for frequent travelers.

- Signup Offers: New cardholders can potentially benefit from generous sign-up offers, such as receiving up to 80,000 miles for new DBS customers. Existing DBS customers are not left out, with opportunities to receive 60,000 miles on sign-up.

Disadvantages

- Annual Fee: The card comes with a substantial annual fee, which may outweigh the benefits for some users, especially after the first year where the cost must be carefully justified against the rewards.

- Income Requirement: The minimum annual income requirement to qualify for the DBS Vantage Card is S$120,000, which may limit accessibility for a number of potential cardholders.

Comparative Analysis

In assessing the DBS Vantage Card, we draw comparisons to its peers and evaluate its standing in the premium credit card market in Singapore.

Competitor Comparison

When comparing the DBS Vantage Card to others in its category, we look at key features such as rewards points, annual fees, and exclusive benefits. The Vantage Card’s closest competitors include the American Express Platinum Card and the Citi Prestige Card.

- Rewards Points: The Vantage Card’s earn rate is competitive, offering 1.5 miles per S$1 spent locally and 2.2 miles per S$1 on overseas expenditure. In contrast, the Amex Platinum Card provides a similar rate for its Membership Rewards Program.

- Annual Fee: DBS charges an annual fee for the Vantage Card but offers a sign-up bonus that can offset this cost in the first year. For example, existing DBS customers can receive up to 60,000 miles, and new customers may get up to 80,000 miles. The competitor cards often have similar or higher fees and various welcome offers.

- Benefits: Benefits of the Vantage Card include dining and travel privileges. This card’s offering is similar to what others provide in terms of airport lounge access and hotel status upgrades.

Market Position

The Vantage Card’s market position is unique, targeting a specific segment within the mid-tier to premium cardholders with a minimum annual income requirement of S$120,000. Although it’s DBS’s first entry at this tier, it effectively competes with other established mid-tier travel cards by offering a balance of rewards and exclusive perks. Each competitor card has its unique value proposition:

- The American Express Platinum Card is known for its lifestyle privileges, especially in dining and experiences.

- The Citi Prestige Card appeals to avid travelers with its complimentary fourth-night stay at hotels and its broad network of lounge access.

Considering the competitive rewards rate, sign-up bonuses, and travel perks, the DBS Vantage Card is positioned well against its competitors for consumers who can make the most of its miles accumulation and spending rewards.

User Reviews

In our analysis of user feedback on the DBS Vantage Card, we’ve identified prevailing sentiments that are categorized as positive feedback and criticisms.

Positive Feedback

- Sign-up Offers: Users appreciate the lucrative sign-up offers, such as the 60,000 miles for existing DBS customers and 80,000 miles for new customers.

- Reward Program: The high earn rates of 1.6 miles per dollar for local spending and 2.4 miles for overseas spending are often praised, making it competitive in the travel credit card market.

Criticisms and Concerns

- Benefits Limitations: Some users express disappointment over the lack of unlimited lounge access and absence of airport limousine benefits, noting that inclusion of these perks would elevate the card’s value proposition.

- Comparative Value: Concerns have been raised about whether the card remains the best option for local spends, with alternatives such as the HSBC Revolution Card potentially providing higher earnings of 4 miles per S$1 on PayWave transactions.