What makes Robinhood different from others is that they do not charge commissions for options, stock, or cryptocurrency trading. Because the industry has been going through a lot of changes lately, some more companies are following suit- offering free commissions. This makes you wonder; how do they make money then?

Robinhood’s target market is the younger investors who flood to the app because of the keywords such as “democratization” and “free”. Surprisingly, this method has worked, attracting around 10 million customers worldwide. The question, however, is, what happens when this number surpasses the company’s research abilities or when the market surges? Ponder this…

When the market was volatile and declining, trading activity was compromised in the first quarter of 2020. As a result, Robinhood suffered major outages that made it difficult for users to access the website, which resulted in a couple of lawsuits. However, if you have clearly checked out the company’s documents, it is not to be held responsible if such outages ever occur.

Key Features of Robinhood

Friendly Mobile App

Even though trades can use the web-based version, this platform feels like a mobile-first organization. Thus, its most popular version is the mobile application. There isn’t much on the app, that’s why it is easy to navigate, especially as soon as you understand how every function works. You can swiftly navigate from screen to screen, analyzing stocks and placing orders.

There is a search bar on the top of the screen where you can search for stock and see charts on any timeframe. It works pretty well and without any lags. Thus, you won’t wait for long before it loads. You will see all the important statistics including market cap, dividend yield, as well as highs and lows.

Also, you get to see a brief profile, a composite of analysts’ rankings, and news feed. If you want to buy or sell, there is a trade button that follows you as you scroll down the page to let you submit your order anytime that you want.

The order entry lets you feed in options contracts or the number of shares that you want and also indicates your purchasing power. After that, you swipe up to place your trade. You can place stop orders, limit orders, and market orders. Other than placing orders, you can easily navigate around the platform to find your account value, portfolio or access account management options.

Where the Platform Rocks

Free Trading

ETFs, stocks, cryptocurrency, and options. Make sure that you check at all times. Robinhood allows you to trade them for free and this is a great benefit for traders, more so options investors. While traders can find free ETF trades and stocks at various brokerages, the main differentiator for this platform is the free options trading.

As you may already know, it is quite easy to pile up huge bills if you trade in and out of the market. this is because each contract attracts a broker fee. That approach quickly racks up the costs. What about for Robinhood? Well, they do not charge any fee for contracts, making it ideal for traders who are just getting started in the market. You also get to trade cryptocurrencies commission-free, too. But as for now, it is only some states that can do this, the company project to add more, though.

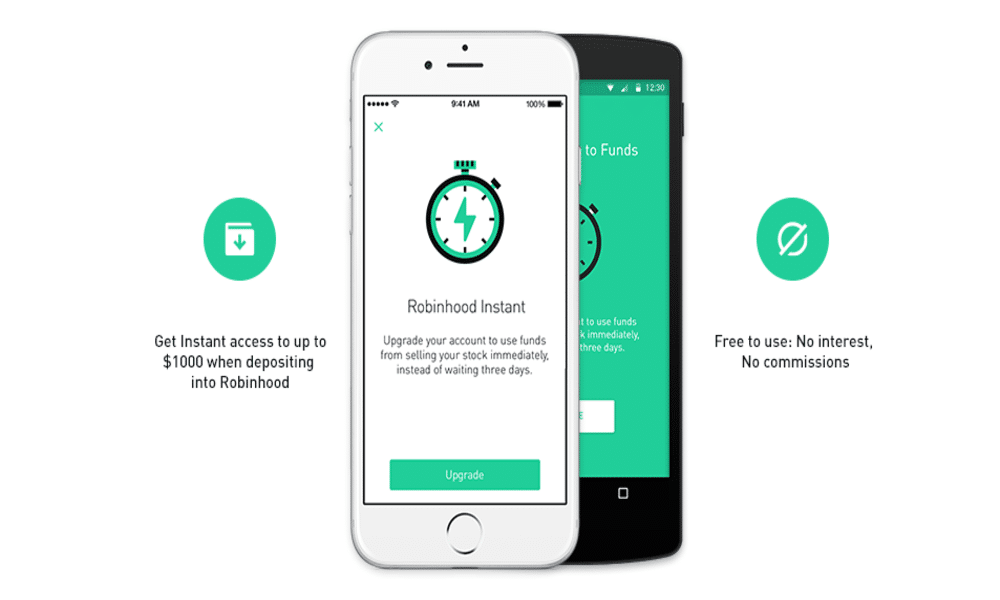

Account Minimum and Fast Funding

Robinhood does not require traders to have account minimum, thus its funding process is way better. If you have worked with a brokerage account in the past, you then know it takes some time to wire your money into your account. This is one unique feature of this platform.

Robinhood lets you send money quickly into your account. The company has partnered with some big banks to reduce the hassle of conventional verification of reporting small deposits into your bank account. Thus, the app lets you transfer up to $1000 into your account, with the rest of the money transferring a couple of days later. Hence, you get in the game faster.

Robinhood Gold

This is the program that does the research and lets you purchase securities with borrowed funds or margin. The platform charges a fee of $5 per month and offers you details of more than 1700 firms including Nasdaq Level II quotes and margin loan access.

The amount charged also includes the interest on the first $1000 in borrowing and the following payments are charged 5% per year. There is a loan interest that is charged on each traders’ accounts every 30 days. If the account balance is zero, the amount will be carried forward to the next month. It is worth noting that a margin account should have not less than $2000 in it, as per industry regulations.

Where the Platform Could Improve

Education materials and Limited Free Research

Well, you will always miss something if you pay nothing for your trades and you can easily tell this in the few free research and education materials that Robinhood offers. This may not affect the right trader- skilled and experienced, but may not be ideal for new traders who normally require help from their broker.

In its Gold program, Robinhood providers ratings from Morningstar, while at the same time-sharing newsfeed and analysis from top sites for stocks. There are some basic charting features as well. However, it is not as efficient as full-service brokers like E-Trade and Charles Schwab. Also, these established platforms provide extensive free education for traders looking to power up their knowledge and skills.

Accounts are limited

This platform isn’t a full-service brokerage. Therefore, do not expect to find better features like those found on other platforms. As a matter of fact, you will find only one account- the individual taxable account. Thus, not 529 accounts, no joint accounts or IRAs.

Customer Service

We commend the customer support. The broker’s page has almost all the answers that you may be looking for. Alternatively, you can try the chatbot. Away from that, you could be hard-pressed to stumble upon a solution without contacting the customer support directly. If you are looking for urgent assistance through phone, you will strive a lot to find their number.

Commissions

As we have mentioned earlier, Robinhood charges no commission to its traders. So, there shouldn’t be much surprise. You will pay nothing for ETF, stock and option trades you place via website or app.

It is very hard to find a brokerage firm that charges nil on trading. Even though there are a couple of brokerages that have reduced their base commission on options traders, most of them still charge a tiny percentage per-contract commission. Robinhood on the other hand, lets investors purchase and sell stock options without any commissions.

Buying ETFs and Mutual Funds

Because Robinhood does not charge any commission on trading, you can trade ETFs for free as well. However, the brokerage does not feature mutual fund trading, which is not a good thing given most of its competitors do offer this feature. Even though the platform integrates mutual fund features, you cannot buy shares of your ideal mutual funds via the platform.

Fees You Ought to Know

Just to reaffirm, Robinhood doesn’t charge investors to trade on its online and mobile platforms. But this does not mean the brokerage is entirely free. You may be required to pay for some things. Here are some common fees you may encounter:

- Domestic/International wire transfers: $25/$50

- Returned check or ACH fee: $9

- Paper statements: $5

- Domestic overnight check delivery: $20

- Paper trade confirmations: $2

Trading Platform

Since its inception, Robinhood was a trading app platform- nothing more! it was not a functional web portal, not at all. But things later changed and now the brokerage has expanded via its web version. The mobile and web versions have a simple design and are easy to navigate. Robinhood makes a perfect platform for customers who like simplicity. Currently, the app has 4.8- and a 4.5-star rating on the Google Play Store and App Store, respectively

Related: Forex.com Review

Margin Rates

The Robinhood Gold premium costs $5 per month. The premium version allows you to invest with borrowed money. What’s more, the first $1000 of margin balances are free of charge. Thus, you will not be charged on smaller margin trades.

In addition, the platform asks for a flat margin interest rate on the amount of your balance if you have more than $1000, and the rate is quite competitive. As of February 2020, the flat margin rate of the brokerage is 5%, less than most platforms out there. Moreover, you will need to have $2000 in your account to use as a margin. This is mandatory for all brokerages, not just for this platform.

Research Offerings

Robinhood is light on features and one of them is research. As a matter of fact, you will only find research on the Gold version of the platform. Customers using this version can access stock research reports from Morningstar. If you are looking for stock research from different companies, then do not rely on Robinhood, you won’t find much here anyway.

Customer Support and Service

This is also a disadvantage of this platform. There is not active customer support. Instead, customer service is handled via the help page on the website and its automated chat system. Even though you can email customer support, it is very had to find a quick response. Human customer support is done exclusively through email. The website does not even have a published phone number.

Robinhood Is Right for You If…

Free Trade

This brokerage will only be ideal for people looking to trade for free. The platform offers app-based and free web-based stock trading and offers free crypto and options trading. It is also one of the simplest designs on the market. it does not spot many features. So, what it doesn’t have in features, it makes up for is the easy-to-use interface.

You want to Trade Cryptos

Only a handful of trading platforms would let investors trade cryptos. With Robinhood however, investors can trade up to 17 different cryptos in the same app.

Ideal for New Traders

Robinhood is ideal for investors that are just starting and have little capital to invest. With the ability to purchase small shares of stock with less than $2, this makes Robinhood an excellent choice for traders who are getting started.

You are Looking for Brokerage and Savings in One

Robinhood sees customers’ uninvested funds as a high-yield savings account. It boasts an APY that is much better than most online savings banks.

You don’t want to Trade Bonds or Mutual Funds

Robinhood is ideal for cryptos, options, ETFs, and stocks. However, if you want to invest in individual bonds or mutual funds in your brokerage account, too bad for you- Robinhood doesn’t offer this feature.

You are Looking for a Basic Brokerage Platform

Other than lacking mutual fund investing, Robinhood also does not offer retirement features such as IRAs. Besides, you cannot open partnership, a trust, custodial, 529, or Coverdell, or any kind of brokerage account via Robinhood.

Pros

- Market news notifications.

- Free trades.

- No-fee cash transfers.

- Crypto.

- No minimum deposit.

Cons

- Limited functionality.

- The app is prone to failure.

- Only one type of account.

Well, here is the thing, if you have never traded on any platform before, then you may find it difficult to navigate through Robinhood interfaces the first time. It is not always easy to find what you want in the app. However, once you master how to trade, everything else becomes easy.

Wrapping things up…

Robinhood is a nice way to get started in the online trading world, with absolutely no fees. The brokerage continues to add new features to its catalog including options trading, web-based platform as well as crypto.

Even though it is not the best or the most powerful platform for investing, it is still an ideal option for an individual stock trading account. We agree that it is not perfect, but it still offers great value. Plus, there is no way you can beat anything free.

Read Also: