Most beginners find investing an intimidating ordeal. But unlike in the past, today it is much easier to start, thanks to new platforms and tools. WeBull is one of the beginner-friendly investing platforms that traders can leverage. In this review, we will dive deep and get to understand what WeBull is, and what it can do for you.

What Is WeBull?

WeBull was established in 2017. It is a mobile trading platform for ETFs and stocks. The platform allows you to trade stocks without paying commissions. The Financial Industry Regulatory Authority (FINRA) and SEC are the two key bodies that regulate the brokerage.

WeBull boasts numerous features, but their main offers are margin accounts and individual cash. You can open these accounts easily and use them for IPO, ETF and stock trading. The account doesn’t attract any inactivity charges. Thus, you can use your account passively if you so wish.

One benefit of using this platform is its simplicity and convenience when trading. Moreover, you can use different extra features, which you will learn more about throughout the article.

WeBull Order Types

WeBull features some order types that give investors a lot of freedom. The platform offers these order types:

- Market orders

- Stop orders

- Limit orders

- Stop limit orders

- Bracket orders

- Take profit orders

- One-cancels-the-other orders

WeBull Features

Real-Time Data

WeBull is popular for data. Before becoming a fully trading platform, the app was investment research. So, it offers real-time market insights and analytics on the US markets at no cost. If you want data on global markets, you can subscribe to the premium version. As you may know, WeBull makes money from selling global market data.

However, you do not need to pay anything to access real-time data on the US market. real-time data is important when making trading decisions. Keep in mind micro-trends are common and they can affect anyone who capitalizes on them. When there is a delay in reporting of capital data, it could cost you big time.

Trading Simulator

The onboard trading simulator is another notable feature by WeBull. Trading or investing stocks for the first time can be an overwhelming and stressful ordeal, especially if you are handling a trading platform for the first time.

The trading simulator lets you practice in “sandbox mode” with demo cash to improve and enhance your skills, learn more about the brokerage and learn how each order type works. You have $1000,00 of fake deposit to trade with, letting you practice execute trades without losing real money.

Commission Free Short Selling

If you are interested in short-selling, the brokerage offers one at no cost. However, you can only conduct sales with your margin account. The minimum balance required to open an account is $2000.

In this type of trading, you are betting against a stock through the borrowing of shares intending to repurchase them in the future. To be precise, you make money when an asset or stock depreciates in the future. A lot of free trading platforms don’t offer sort selling, but WeBull does this at no cost. Short selling is common when traders do not sell their stocks because they believe the stock value will reduce.

If the stock price falls, short-sellers purchase the stock at lower prices and if the prices shoot, sellers will incur a loss.

Understanding Margin Trading

As aforementioned, to conduct short selling, you must use a margin account. Margin trading is a kind of borrowing that allows traders to leverage money and securities that they have to acquire extra security. Most trading platforms loan $1 per $1 invested in securities. For instance, if you have $20,000 worth of stocks, WeBull will give you $20,000 extra to invest with.

A margin account allows you to borrow money from a trading company, it lets you leverage your investment to increase your revenue. On the same page, it can also multiply your losses.

Extended Trading Hours

Just like any other business, the stock market too has hours of operation- from Monday to Friday, typically from 9:30 am to 4 pm EST. The basic majority of trading platforms will let you place trades within this window period.

WeBull allows investors to place a trade from 4 am to 8 pm EST, from Monday to Friday. This comes in handy for investors who want to trade stock during earnings and dispose of them after the bell. However, price volatility can go high during extended hours as opposed to normal market hours. So, it would be best if you limit prices to place an order.

Can You Day Trade with WeBull?

WeBull allows you to day trade stocks, although we do not recommend traders to do this. You should be familiar with a concept known as DT Call or Day trading. DT Call usually happens when the day trading is more than the largest day trading buying power that a brokerage issue to you.

You can only meet a DT Call by depositing money in the full amount of the call. You cannot liquidate your stocks; it won’t help meet a DT Call. As such, money should remain in the account for not less than 2 business days before your account is stable.

Related: Robinhood Review

WeBull Research Tools

Fundamental Data

Fundamental traders study the financial status of a company to make informed bets. They analyze key financial statements such as cash flow statements, balance sheets, and income statements. Also, they analyze key metrics such as PE ratio, earnings per share and so much more.

WeBull has all this information at your disposal. You can check the numbers from key financial data and check the visual graphs of the trends. They also feature comparison tools that help you compare different metrics for different firms within the same industry.

Technical Data

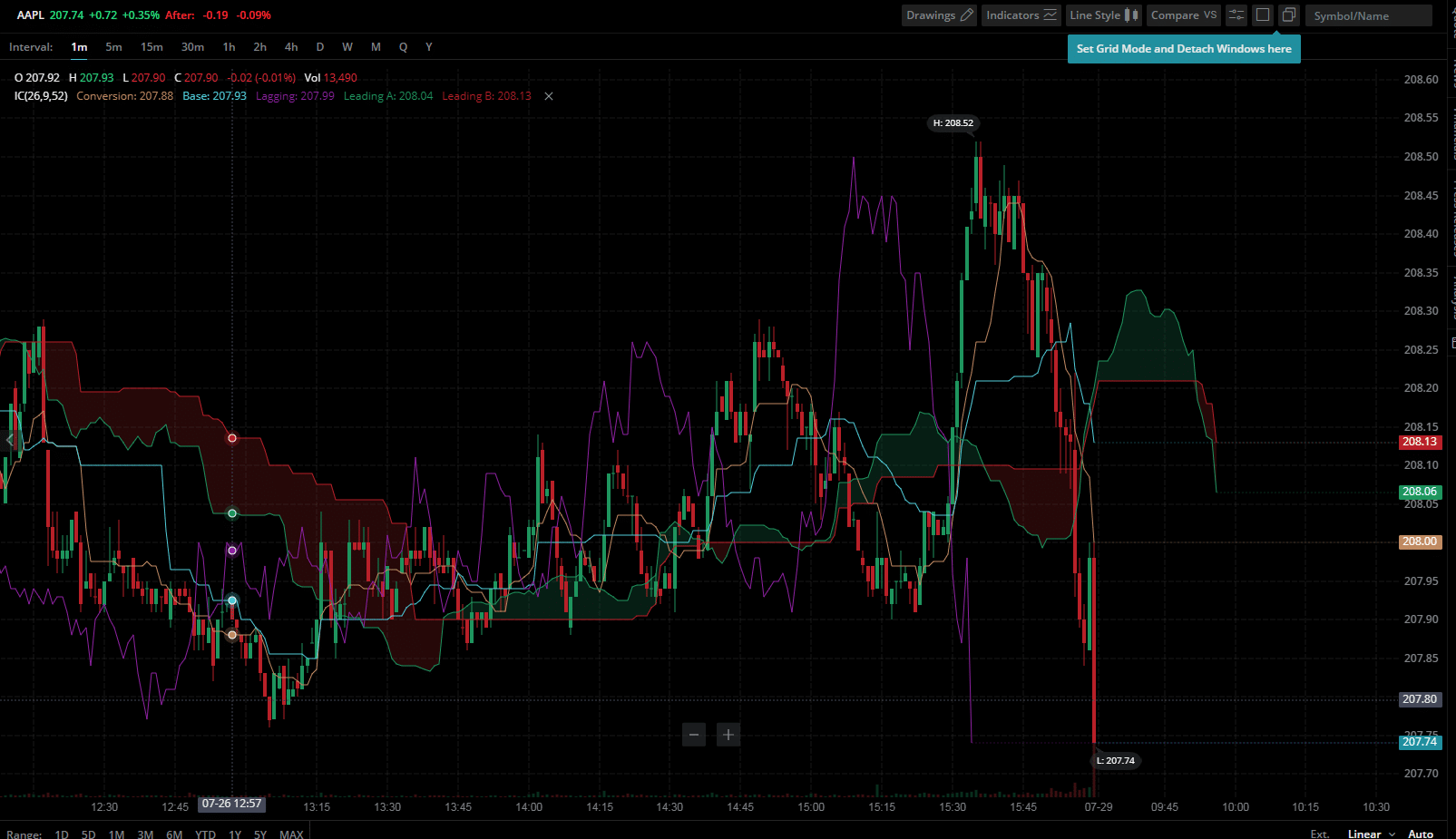

People are different, and not everyone prefers the fundamental approach when making financial decisions. Most traders depend on technical analysis, which is check charts as well as the following trends. WeBull has more than 20 different technical indicators on its platform.

Traders use these charts to spot micro trends to leverage on. Other platforms don’t offer these many indicators, which include volume, Bollinger bands, candlestick charts, moving averages, RSI, and MACD.

Financial Calendars

This is yet another resourceful feature by WeBull. The calendar displays upcoming dates for a firm including earning reports and dividend payments. Moreover, some calendars show what firms are reporting earnings every week and what their public offerings and IPOs will be like the following week.

Watchlists And Alerts

The brokerage lets you create watchlists of stocks you would wish to analyze. Moreover, you can set price alerts so that you can get notifications from the platform when the price gets to your ideal level. For instance, if you want to purchase a stock for less than $200, you can set a price alert so that when it reaches this figure, you get a notification.

Fees and Commissions

As we mentioned earlier, WeBull does not charge any fees or commission on its platform within the promotional period. However, there are the usual fees for regulatory authorities and clearing houses, FINRA and SEC trades, which are deducted from every trade in all brokerages. Keep in mind these fees are passed to all agencies. So, WeBull do start charging once the honeymoon period is over.

If you are funding your account via TT/ wire transfer, the initial deposit will be free. Thereafter, some fees may be requested. Automated Clearing House (ACH) is also free of charge because this is a direct electronic transfer from your bank to the platform. we recommend using Paynow for 0 bank charges.

Understanding Market Order

The market order is triggered the moment you place an order and it will indicate at the current market price. Keep in mind that the fill price might differ from the market price indicated while you were placing the order. This is because of low liquidity. However, we do not advise traders to try market order, especially if they do not have control of the range of fill price.

Understanding Stop Order

A stop order becomes active at a pre-determined stop price and becomes a market order once it is filled at market price. If the market price fails to reach the stop order, it will not go live. Note that the stop price doesn’t warranty some filled price when it is executing as a market order.

Let us assume that the current market price is $100:

So, if you submit a buy stop order at $110 and later the market price shoots to $110, it will trigger the buy stop order, which will turn it into a market order and get filled at the closes price to $110, based on volume at that price.

Understanding Stop Limit Order

A stop-limit order becomes live at your pre-determined stop price, allowing you to fill the order at your limit price. For instance, if you have $100:

You can submit a buy stop limit order at $120 and limit the price at $140. When the market price reaches $120, then the limit price of $140 will be triggered by the market. but if the stock gap is more than $140, the order will not be filled.

On the other hand, if you submit at stop price at $110 and limit price $100, and the market price falls to $110 in the future, the order will be filled at a price not less than $100. If the stock gap is less than $80, then the order will not be triggered.

A Limit Order

This is when you trigger an order at your designated price and it fills at the limit price. If the market price falls to reach this limit price, then the order is not triggered.

Let us assume the current market price is $10:

Suppose you submit a limit order at $8 and the market reaches $8, the market will become active at fill at a price at $8. Now, if the sell limit order is submitted at $12 and the market price reaches $22, the trigger will fill at a price of at least $12. Keep in mind that the shares trade must be sufficient to fill your order.

Customer Service & Paperless Statements

WeBull brags 24-hour customer chat support. They also offer phone and email support during market hours. Besides, the company keeps all communication between traders and the company confidential, and everything will be handled electronically, including year-end tax documents and monthly statements.

Is WeBull Legitimate and Safe?

The answer is YES!

WeBull is one of the safest trading platforms on the market right now. Your account is protected by SIPC insurance, where you are covered with up to$250,000 cash or $500,000 of securities. However, the insurance policy does not cover losses experienced within the account.

Transferring Stocks from Another Trading Platform

The brokerage supposed all the US stocks on the WeBull platform. This means you can buy or sell securities and even transfer in and out of your account. It covers the vast majority of ETFs and listed equities. But several ETFs and stocks are not supported for trading by its clearing company, Apex. At the moment, WeBull does not support mutual funds, options, bonds, penny stocks, and pink sheets on OTC markets.

Advantages of Trading with WeBull

- Free hours of trading for all users.

- Commission-free for all trading.

- Supports basic order types and several advanced order types.

- Availability of fundamental data and technical strategies.

- Trading simulator available for amateurs to familiarize themselves with the platform.

- Desktop and mobile applications

- 24-hour customer chat support.

- Extra insurance cover by Apex Clearing.

- Free IRA.

Disadvantages of Using WeBull

- Customer service can only be accessed through phone and email during market hours.

- Traders have to pay for global market data, except for the US market data.

- It may be too complicated for a beginner.

- No dividend reinvestment or fractional shares.

- Lacks prebuilt portfolios.

- for USD and HKD withdrawals, there will be a handling fee of SGD20 charged by the remitting bank.

Conclusion

If you want to start trading stocks, consider trying WeBull- the platform has some interesting offers, including commission-free trading. If you are a skilled or experienced investor, we believe there are better options in the market. if you are also looking for other types of investments, WeBull may not be ideal for you. But all in all, it is a stable, legitimate and lucrative platform.

Read Also: