If there ever was a lesson we need to take from the Black Wednesday trade, it is, artificially controlling something that cannot be controlled is bound to backfire on you.

Prior to the European Union being commissioned there was something called the European Exchange Rate Mechanism (ERM for short). Post the world war the European countries decided to band together and integrate economically to stop fighting with each other and create wars.

As the Deutschmark was the strongest currency at that point, the European countries decided to align their currencies with it. One decision they took, which in hindsight was a very bad move was to fix their currency to the deutschmark. This meant they would artificially keep their currencies hovering around plus or minus 6% from the deutschmark.

Currencies are one of the most volatile trading assets in the world. People are buying and selling all the time, imports and exports affect currency. The rate of a currency is dependent on supply and demand and is priced automatically. Countries can take slight measures in improving the exchange rate, like buying and selling their own currency.

Read also: Warren Buffet’s Early Investment Strategy

The Iron Lady, Margaret Thatcher was who was the Prime Minister in the 90’s stood for the price of the pound to be set by the markets. As she did not have enough fire power then to convince her colleagues, then future Prime Minister, John Major decided to join the ERM. This meant that the GBP was at a fixed rate against the Deutschmark.

The thinking behind this was, with a strong Deutschmark, the GBP would be anchored with it and the stability of the Deutschmark would rub off on the GBP. This was lazy thinking by hoping that the currency would remain strong because of another strong currency.

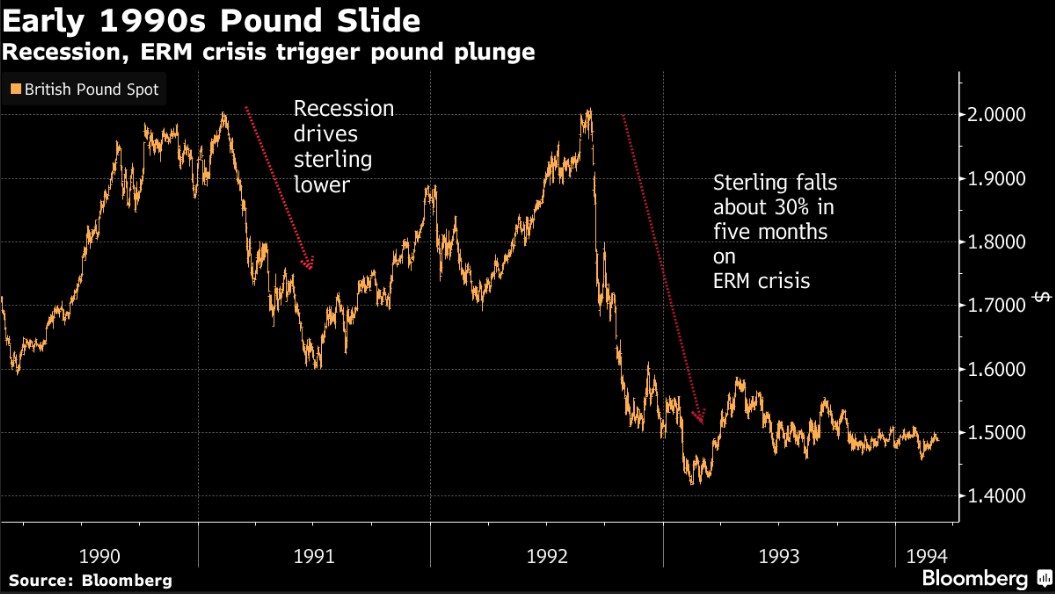

Alas, economics isn’t that simple and there are so many other factors. In 1992 a recession hit and more than 12% of the Employable population were unemployed. The right thing in this case would be to reduce the interest rates that would increase investments and spending. But this action could not be undertaken because of the commitment to the ERM that the GBP rate would be fixed.

A simple analogy would be is to drink no water when you are parched because of your commitment to an authority figure that you will not drink more than a certain amount of water.

Cometh the hour, Cometh the man.

George Soros was a hedge fund manager and had run his fund Quantum for twenty years by then. It was one of the most successful funds in the history of the world over the years because of consistent returns.

Soros was looking at the happenings of the currency like a hawk. And here was the situation. The GBP wasn’t reflecting it’s true value because of Britain’s commitment to the Deutschmark and maintaining the fixed price. But, George Soros knew that sooner or later the currency will have to plummet to reflect the true happenings of the British economy at that time.

He took big a big bet and decided to bet against the GBP. This meant he was buying positions where he hoped the currency would go down and he would make money from it. To, Soros this was inevitable, the currency had to go down and Britain can try to artificially keep the currency high only for a certain point of time.

Soros and his team of managers had slowly increased their bet against the GBP to $1.5 Billion. Soros had other plans. The position that they slowly built, Soros asked his team to increase it rapidly, to go big. What started out at $1.5 Billion, went all the way up to $10 Billion in no time.

At this point of time, the Germans told the press that it was ridiculous that the sterling was still at the same level and it was only inevitable that it would be devalued or go down.

Read also: Advice from Jack Ma to Young People on how to Live your Life

The Prime Minister then, till that point in time had not touched the Interest rates and did not want to. To keep the currency intact, the British bought close to 26 Billion Pounds of their own currency to keep the price high. This still was not enough. In a last ditch effort, they decided to increase the Interest rates to make people purchase the GBP. The whole world was selling and the only ones who were buying was the British government. The markets weren’t believing it anymore that this currency could remain intact.

It was September 17, 1992. A Wednesday. The GBP crashed. It crashed 25% against the US Dollar. George Soros was right and his push for the jugular netted his fund a cool $1 Billion. Never heard of before.

George Soros’s ability wasn’t one fold, it was multi-fold, he knew the fundamentals, he knew how to profit from other people’s mistakes, he knew how to bet big. All his efforts led to this. One man, in One day made One Billion US Dollars.