The UOB PRVI Miles Card has made a name for itself in the Singaporean credit card market, especially among those who prefer to earn travel rewards. Offering a competitive mile earn rate on both local and overseas spending, it attracts those looking to accumulate miles quickly without paying a high annual fee. One of this card’s highlights is its relatively low entry threshold for income, which stands at $30,000 for Singaporeans and $40,000 for foreigners, making it accessible to a wider audience.

Managing the UOB PRVI Miles Card is simplified with UOB’s digital banking platforms, which allow for easy monitoring and redemption of miles. In addition, the card provides promotions on travel bookings through select platforms that have been known to offer bonus miles. Moreover, it’s critical for potential cardholders to evaluate the fees, terms and conditions associated with the card to ensure it aligns with their spending habits and financial goals.

Here are some of our top picks on:

- Review: KrisFlyer UOB Credit Card Singapore

- Review: UOB Visa Signature Card Singapore

- Review: DBS Woman’s World Card

Key Takeaways

- The UOB PRVI Miles Card offers a high miles earn rate for both local and overseas expenses.

- Accessible to a broader range of incomes, the card is user-friendly in application and management.

- It is important for users to assess associated fees and card terms to ensure suitability for their financial needs.

Card Overview

In our analysis, the UOB PRVI Miles Card positions itself as a strong contender for avid travelers, offering appealing earn rates and attractive welcome offers.

Key Features

- Airport Limo Benefit: Cardholders may enjoy airport limousine services, subject to the card’s terms and conditions.

- Payment Networks: Available across multiple platforms including American Express, Visa, and MasterCard.

- Shenanigans Alert: UOB’s card management could require vigilance due to various banking practices.

Earning Rates

- Local Spend: Earn 1.4 miles per dollar on local expenditures.

- Overseas Spend: Earn 2.4 miles per dollar on overseas transactions.

- Travel Bookings: Promotional rates apply for bookings through certain travel sites, including up to 6 miles per dollar on platforms like Expedia and Agoda.

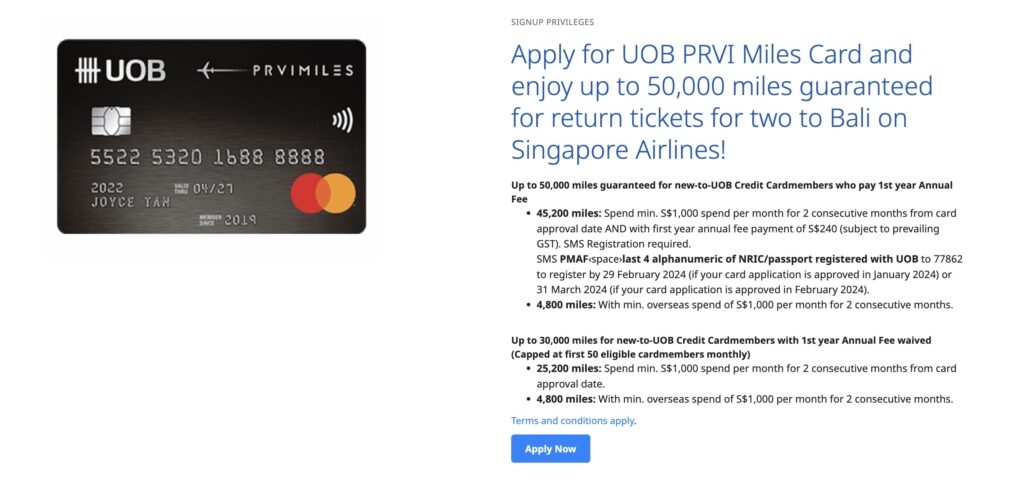

Welcome Offers

- Bonus Miles: New cardholders may be eligible for sign-up bonuses, though specific offers should be confirmed as they are subject to change.

- Promotional Periods: Welcome offers often include a limited-time opportunity to earn additional miles for early spendings.

Rewards and Benefits

Our review of the UOB PRVI Miles Card focuses on its generous rewards and benefits, which cater to frequent travelers and those seeking value in everyday spending. Users can accrue miles quickly, enjoy travel perks, and access lifestyle privileges that enhance their spending experience.

Mileage Program

- Local Spend: Earn 1.4 miles for every $1 spent locally.

- Overseas Spend: For expenses abroad, the rate increases to 2.4 miles per $1.

- Bonus Miles: For bookings with major airlines and selected hotels through specific platforms, members can earn up to 6 miles per $1.

Travel Perks

- Airport Limo: Benefit from the complimentary airport limo service, subject to meeting minimum spend requirements.

- Welcome Offer: New applicants may receive up to 50,000 miles after meeting the criteria of a minimum spend and other conditions within specific promotional periods.

Lifestyle Privileges

- UNI$ Expiry: Any UNI$ (UOB’s rewards currency) earned will have a two-year expiry, providing ample time to convert them into miles.

- Income Requirement: The card has a relatively accessible entry-level income requirement, which is $30,000 annually for Singaporeans and $40,000 for foreigners, making it appealing for a wide audience.

Fees and Charges

In this section, we provide detailed information about the fees and charges associated with the UOB PRVI Miles Card. Understanding these costs is crucial for cardholders to maximize the card’s benefits effectively.

Annual Fee

The UOB PRVI Miles Card comes with an annual fee of S$259.20. This fee is inclusive of the prevailing Goods and Services Tax (GST). In some promotional periods, cardholders may receive bonus miles for paying the first year’s annual fee.

Interest Rates

UOB PRVI Miles Card charges an interest rate of 25.9% per annum on outstanding balances. This rate applies to unpaid balances after the interest-free grace period, which is typically around 25 days from the statement date.

Foreign Transaction Fees

For transactions made in foreign currencies, the UOB PRVI Miles Card imposes a foreign transaction fee of 3.25%. This fee is a combination of currency conversion and administrative fees for cross-border transactions.

Eligibility and Application

When applying for the UOB PRVI Miles Card, we ensure that applicants meet specific criteria and provide necessary documents. Our structured application process facilitates a smooth and straightforward acquisition of the card.

Eligibility Criteria

To qualify for the UOB PRVI Miles Card, applicants must:

- Be at least 21 years of age

- Have a minimum annual income of:

- S$30,000 for Singapore Citizens and Permanent Residents

- S$80,000 for Foreigners

Required Documents

Applicants are required to submit:

- For Singaporeans and Permanent Residents:

- Photocopy of NRIC (Front and Back)

- Latest original computerized payslip or

- Last 12 months’ CPF statement or

- Latest Income Tax Notice of Assessment

- For Foreigners:

- Passport copy

- Employment Pass (with a minimum of six months’ validity)

- Latest Income Tax Notice of Assessment and

- Original computerized payslip

Application Process

Our application process is conducted as follows:

- Complete the application form online or at a branch.

- Provide all required documents for verification.

- Wait for processing and approval, which typically takes about 1-2 weeks.

- Upon approval, the card will be mailed, and an SMS prompt will confirm the successful application.

Applicants can expedite their application by ensuring all documents are complete and accurately provided.

Card Management

In managing the UOB PRVI Miles Card, we have access to both online banking and a dedicated mobile application. These platforms enable us to monitor transactions, track our miles balance, and handle payments effectively.

Online Banking

Our experience with the UOB online banking platform has shown it to be quite user-friendly and robust, ensuring all our card management needs are met. Noteworthy features include:

- Transaction Overview: A real-time display of our spending and transactions.

- Miles Tracking: Easily check our accrued miles and their expiration dates.

Mobile App

The UOB mobile app complements our card management by providing:

- Push Notifications: Instant alerts for transactions and payment due dates.

- Account Management: Allows us to view statements, pay our card bills, and redeem miles from our phone.

Comparisons with Other Cards

When we assess the UOB PRVI Miles Card in the context of available options in Singapore, several points of comparison emerge.

Earnings on Local Spend:

- UOB PRVI Miles Card offers 1.4 miles per S$1.

- Competitor cards typically offer around 1.2 to 1.3 miles per S$1.

Earnings on Overseas Spend:

- Our card provides 2.4 miles per S$1.

- Other travel cards may offer between 2 to 2.2 miles per S$1, making ours a strong contender.

Special Rates with Travel Partners:

- With the UOB PRVI Miles Card, users benefit from 6 miles per S$1 on certain bookings through partners like Agoda and Expedia. This promotional rate often surpasses those of competitors.

Miles Expiry:

- The UNI$ earned with our card expire after two years, a standard tenure among miles cards.

Card Perks:

- A standout feature is the airport limo benefit, a perk that is not universally available with other miles cards.

| Feature | UOB PRVI Miles | Competitor Average |

|---|---|---|

| Local Spend Miles Rate | 1.4 | 1.2-1.3 |

| Overseas Spend Miles Rate | 2.4 | 2-2.2 |

| Booking with Partners | 6 | Varies |

| Miles Expiry | 2 years | 2 years |

| Airport Limo Benefit | Yes | No |

We remain objective and acknowledge that choice often depends on individual spending habits and perks prioritization. Our analysis is based on current figures, which are subject to change.

Customer Experiences

Before diving into the specifics of the UOB PRVI Miles Card, it’s imperative to understand customer feedback concerning their direct experiences with the card. This includes the interactions with customer service and the sentiments echoed in user reviews.

Customer Service

Our examination has revealed that customer service encounters can greatly influence cardholder satisfaction. Cardholders reported that the response time and effectiveness of solutions provided are:

| Aspect | Feedback |

|---|---|

| Response Time | Generally quick |

| Problem Resolution | Often effective |

| Accessibility | Multiple channels available |

The customer service team is accessible via phone, email, and sometimes live chat, with most issues resolved in a timely fashion. However, some customers have noted periods with longer wait times or less satisfactory resolutions, which is not uncommon in the industry.

User Reviews

Turning to user reviews, they are a prominent indicator of cardholder contentment and can sway potential customers’ decisions. Here’s the aggregated sentiment:

- Positive Aspects:

- High earn rates on specific purchases which users find rewarding.

- The convenience of bonus miles for travel bookings.

- Negative Aspects:

- Instances where points accrual isn’t as seamless as expected.

- Some frustrations over the points expiry policy.

User reviews often mention the high earn rates for miles as a significant advantage of the UOB PRVI Miles Card. Nevertheless, the management of UNI$ (the points system) and their expiration has drawn some criticism from the community.

Pros and Cons

When considering the UOB PRVI Miles Card, we observe a mix of advantages and drawbacks. Our analysis brings these to light, helping prospective cardholders to make informed decisions.

Pros:

- High Earn Rates: With the UOB PRVI Miles Card, we earn 1.4 miles for every $1 spent locally and an impressive 2.4 miles for every $1 on overseas expenditures.

- Entry-Level Income Requirement: The card is accessible with a reasonable income requirement of $30,000 for Singaporeans and $40,000 for foreigners.

- Airport Limo Benefits: One of the premium perks includes the excellent airport limo benefit, enhancing the travel experience.

Cons:

- Shenanigans: There have been concerns regarding UOB’s policies and terms that may require close attention to avoid any inconvenience.

- Points Expiry: The UNI$ earned with this card expire after two years, necessitating prompt usage to maximize benefits.

- Initial Spend Requirement: Some bonuses may require a minimum spend within a certain time frame, which could be a hurdle for some users.

By weighing these factors carefully, we can determine if the UOB PRVI Miles Card aligns with our spending habits and reward preferences.

Conclusion

In evaluating the UOB PRVI Miles Card, we find that its appeal largely hinges on its high earn rates and favorable travel benefits. With 1.4 miles per S$1 for local expenses and 2.4 miles per S$1 on overseas spending, this card positions itself as a competitive option for frequent travelers.

The additional perks such as complimentary airport limousine transfers enhance its value proposition, subject to the bank’s terms and conditions. Additionally, the entry-level income requirements make this card accessible to a broader segment of consumers in Singapore, encompassing both locals and foreigners.

However, it’s crucial to be aware of the bank’s specific conditions which may affect reward accumulation. Cautious management and an understanding of the card’s benefits and limitations are essential to optimize its potential.

For individuals prioritizing mileage accrual and who maintain a vigilant approach to managing their credit, the UOB PRVI Miles Card can serve as a potent tool in maximizing travel benefits.

| Pros | Cons |

|---|---|

| High earn rates | Bank-specific conditions |

| Airport limo benefit | Vigilance in card management necessary |

| Accessible income requirement |

To sum up, our appraisal of the UOB PRVI Miles Card underscores its strengths as a miles-earning credit card, with an emphasis on its use by those who travel frequently and can navigate the bank’s stipulations effectively.